What you need before getting started:

- Turbotax Premier Edition (To import TXF you will need the Desktop version)

- Schedule K-1 with Income (can be found in your “documents” section)

You are required to report on your income tax return the Schedule K-1s you’ve received that have taxable income. Generally, you will have taxable income on your K-1 if you owned shares in a Artwork that was sold by Masterworks during the tax year, in which case, you should have received a payout and a Schedule K-1 with taxable income. This step-by-step guide is intended to help you navigate through the TurboTax questionnaire as it relates to reporting taxable income from a Masterworks K-1 you received.

Note you may receive K-1s from Masterworks annually that have no taxable income on them. For example, Box 11 Part III of the K-1 is blank and no Artwork sale was announced. We generally recommend you do not report these “Blank K-1s” since there is no income to report. Adding Blank K-1s in TurboTax will have no effect on your tax return. Instead, keep them for your records.

Important Disclaimer- This guide was prepared for general purposes only and does not reflect any unique facts and circumstances that could apply to you and change the approach for preparing your tax returns. As such we can’t guarantee that this step-by-step guide will achieve accurate tax results for you. We recommend you consult with a tax professional before filing your tax return.

Steps

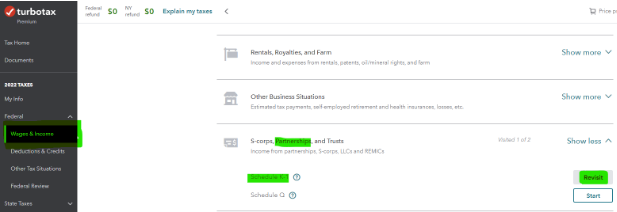

- Start by navigating to the Wages and Income section of the Federal tab on the left side pane. And then Scroll down until you see “S-corps, Partnerships, and Trusts”. Select Start/Revisit Schedule K-1.

- Next, answer yes to the question, “Did you receive any Schedules K-1?”

- Next, click Start/Update for the Partnerships/LLC (Form 1065) type

- Next, enter the Name and Address of the LLC.

- You can get this information from your Schedule K-1 on Part I.

- Next, indicate whether your investment was held through a retirement plan by selecting the box. Then press continue.

-

- Note If this does not apply to you, leave uncheck and proceed to the next screen.

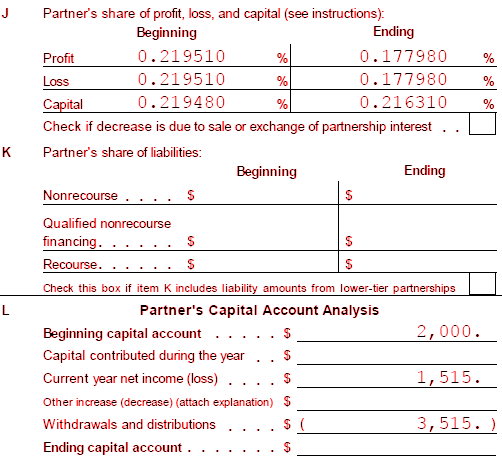

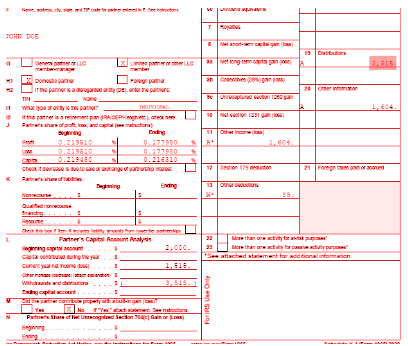

6. Next, for Partner Type, select “Limited Partner or other LLC Member”

7. Next, choose the type of partner, by looking at your K-1 and selecting the options that apply.

-

- If the designation on your K-1 is not correct then use correct information instead.

8. [Optional] Next, enter the following information from your K-1. This has no impact on your tax return.

9. Next, describe the partnership and sale in the following steps

10. Next, enter the sale dates

-

- Note you will need your 1099 for this step. If you did not receive a 1099, check your portfolio section on your Masterworks account for applicable dates.

-

- Sale price: is the amount you received. This amount is generally the Distribution amount on your K-1 or the Proceeds amount on your 1099.

- Partnership Basis:

- If you received a 1099, the Partnership basis is equal to the Cost Basis on your 1099 plus net income on your K-1. See here for more details.

- If you did not receive a 1099, the Partnership basis is equal to your invested amount, plus any net income on your K-1.

- If you received a 2019 and/or 2020 K-1 in prior years, reduce your Partnership basis further by any deductions from on those K-1s.

- Note You may incur an investment gain or loss on the next screen, if the Proceeds you received are not equal to your Adjusted Partnership Basis. This is common and usually a result of buying your shares of Masterworks shares on the secondary trading platform.

12. Review your investment gain, if any.

-

- Not everyone has an investment gain or loss on disposition since this is a unique situation.

13. Next, Choose the type of activity and boxes that apply.

-

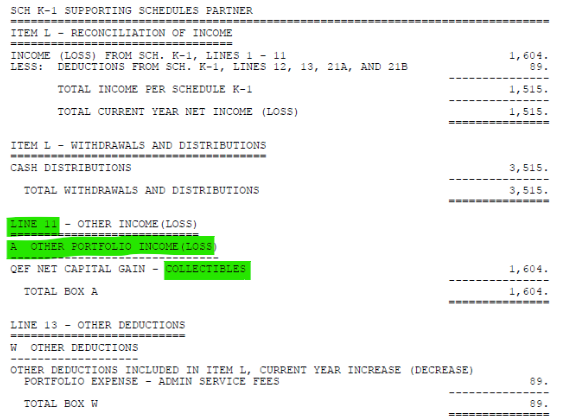

- IMPORTANT. Collectible gains in Box 11 of your K-1 need to be entered in "BOXES 8 to 10” in TurboTax. Ordinary earnings are reported in "BOX 11". Choose only one of these two boxes.

- To determine which one to select, open up your Consolidate Tax Statement or your Schedule K-1. If the gain is subject to the 28% Calculation because it is from Collectible sources as noted, then Select Box 8 to 10.

- If the gain is from Ordinary earnings as noted and needs to be reported on Schedule 1 then Select Box 11.

- Box 13 amounts are generally not tax deductible for most individuals, you do not need to indicate or include this on your tax return in TurboTax.

- Box 16 Schedule K-3 is generally only applicable for tax payers looking to claim a foreign tax credit or that have other foreign investments. If you are not claiming a foreign tax credit or have any other sources of foreign income, then you can generally leave this Box unchecked.

- IMPORTANT. Collectible gains in Box 11 of your K-1 need to be entered in "BOXES 8 to 10” in TurboTax. Ordinary earnings are reported in "BOX 11". Choose only one of these two boxes.

14. Next, to enter the Collectible gains, enter on this screen.

-

- IF ENTERING AN AMOUNT ON THIS SCREEN, DO NOT ENTER IT AGAIN ON BOX 11

-

- [DO NOT ENTER INCOME ON THIS SCREEN IF YOU ALREADY ENTERED IT ON BOX 8-10].

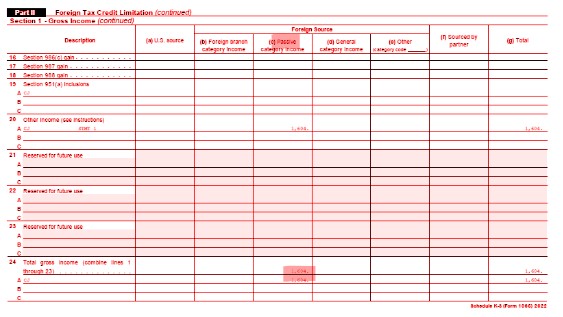

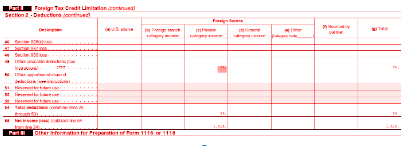

16. Next, Enter K-3 Information following these steps.

-

- Select Cayman Islands and Passive Categories where applicable.

19. Next Describe the Partnership

20. You are all done now. Select Add another K-1 to add another Masterworks K-1 you received that has income that needs to be reported. (Do not add K-1s that have no income, there is nothing to report that will affect your tax return)

We highly recommend consulting with a tax professional prior to filing your tax return. This guide is not tax advice and is only intended to guide taxpayers through the questionnaire as it relates to a Masterworks K-1. There is no guarantee on the accuracy of this guide. Investors are ultimately responsible for the accuracy of their own tax returns. If you have any questions please contact us at tax@masterworks.com