Important Disclaimer- This guide was prepared for general purposes only and does not reflect any unique facts and circumstances that could apply to you and change the approach for preparing your tax returns. As such we can’t guarantee that this step-by-step guide will achieve accurate tax results for you. We recommend you consult with a tax professional before filing your tax return.

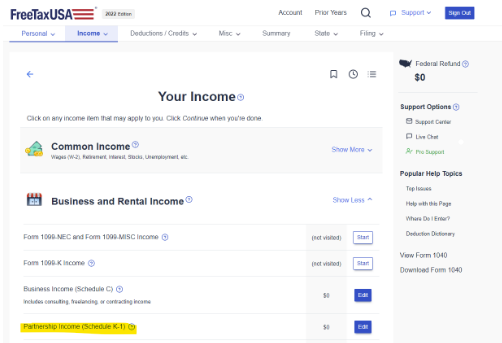

- Select Partnership Income (Schedule K-1)

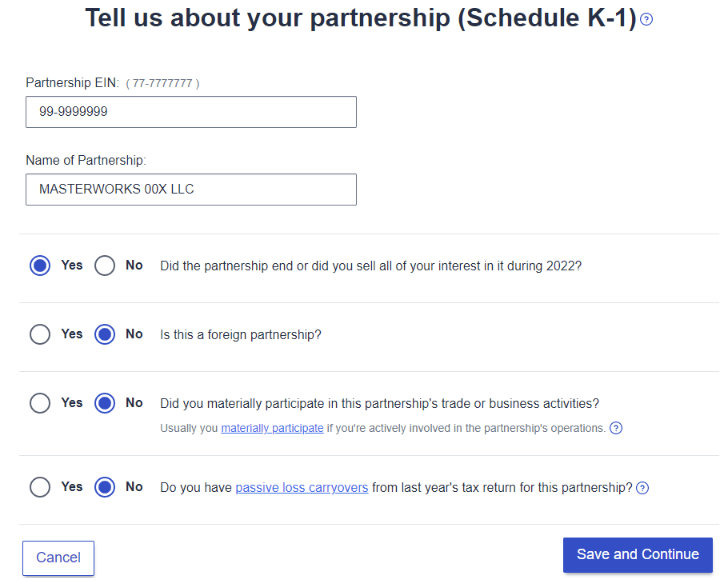

- Enter the EIN and Partnership name from your Schedule K-1. Select Yes to “Did the partnership end or did you sell all of your interest in it during 2023?”

- Continue on to the next page. Select No.

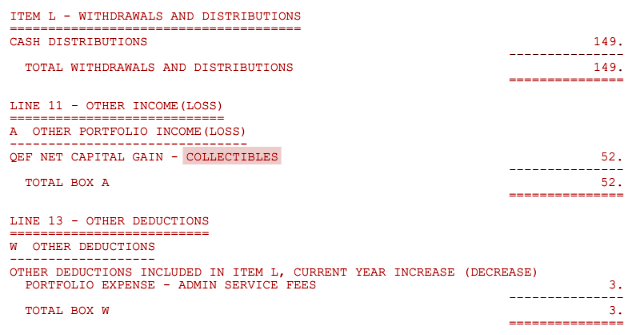

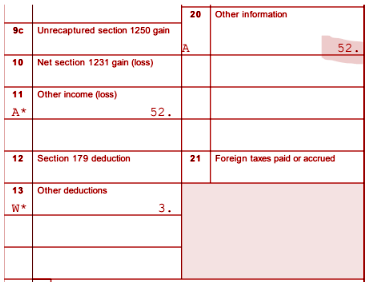

- On the next screen, If your K-1 has Collectible gains in Box 11A, then enter it in the tax software on Line 9a and 9b as shown below. Do not enter any other income on this line, such as Ordinary earnings income from Line 11A.

- If your K-1 has Ordinary earnings Income in Box 11A, then do not enter it in the Partnership K-1 section of Free Tax Usa. Enter it later on in Other sources of Income.

- If your K-1 has Box 13, do not enter it in this section, instead enter it in the Itemized Deductions section later on.

- Select K-3 Box

- Enter Line 20A as per your K-1. (Always enter Line 20A for each K-1 with an amount reported on Line 20A)

- After Entering Collectible gains in Line 9A/9B and entering Line 20A Information, continue on to the next screen. If you have no other K-1s with Line 9A/B or Line 20A, click “No, Continue” otherwise, Select “Yes” to add another K-1.

- Entering in Ordinary earnings Income from your Schedule K-1. Select “Other Income” at the bottom of “Uncommon Income” on the Income landing page. Enter the Ordinary earnings amount as Miscellaneous Income. Then hit Save and Continue.

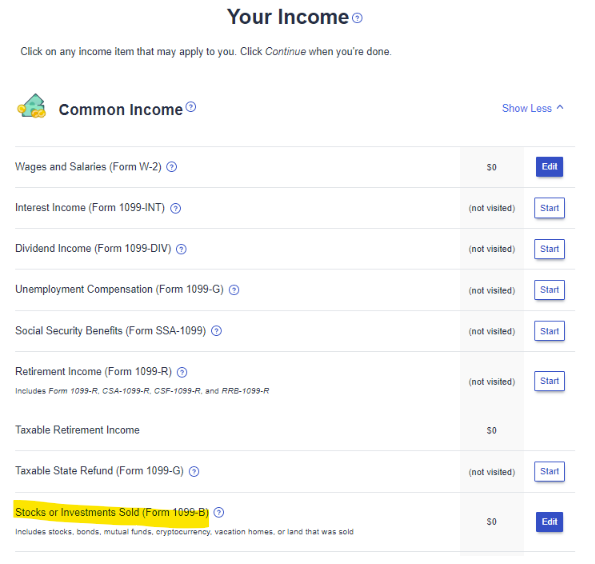

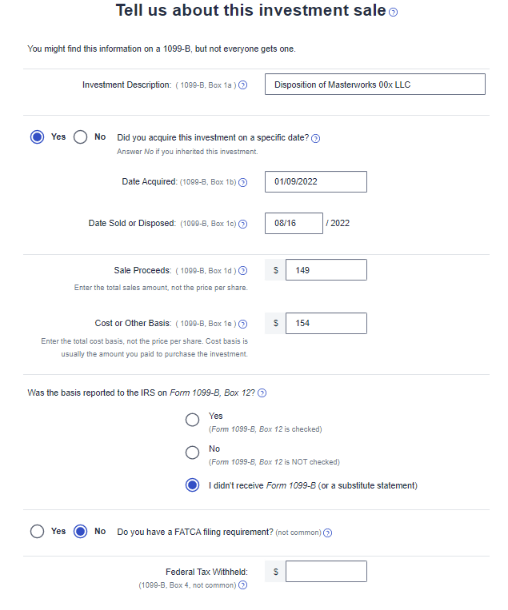

- Lastly, we need to record the exit event, and report any gain or loss. You will need your 1099 to complete this part or navigate to the Portfolio section of your Masterworks account. Once you have it open, navigate to the “Stock or Investments Sold” section of the “Common Income” section on the Income landing page of Tax Free USA.

-

- Use the Information from your 1099 or Masterworks Portfolio section to populate the below. If using Masterworks Portfolio, refer to the historical activity details section.

- Sale Proceeds are equal to the Distribution amount on your K-1 or the 1099 Proceeds amount.

- Cost or Other Basis:

- If you received a 1099, the Partnership basis is equal to the Cost Basis on your 1099 plus net income on your K-1. See here for more details.

- If you did not receive a 1099, the Partnership basis is equal to your invested amount, plus any net income on your K-1.

- If you received a 2019 and/or 2020 K-1 in prior years, reduce your Partnership basis further by any deductions from on those K-1s.

- If you have no more dispositions to report, hit No, Continue. Otherwise Add another Investment Sale to report more dispositions.

-

- To enter Box 13 Information, Note the deduction is generally not deductible for most US Taxpayers, including Individuals. As such there is no place in Tax Free USA to enter the Line 13 amount since it won't impact your tax return.

We highly recommend consulting with a tax professional prior to filing your tax return. This guide is not tax advice and is only intended to guide taxpayers through the questionnaire as it relates to a Masterworks K-1. There is no guarantee on the accuracy of this guide. Investors are ultimately responsible for the accuracy of their own tax returns. If you have any questions please contact us at tax@masterworks.com